Hello Friends, In this blog post(How to Submit Tax Information Form in Google Adsense for YouTube and Blog) we are going to let you know about important updates that are setting up the tax information in your Google Adsense account for your YouTube channel and your blogs.

Within this blog post(How to Submit Tax Information Form in Google Adsense for YouTube and Blog), you will come to know about US tax information which is needed by all the NON-US users who are running YouTube channels and blogs or websites and earning their revenue from Google Adsense.

You have to pay taxes on all the advertising revenue which is done from the US. But it does not apply to other countries. (How to Submit Tax Information Form in Google Adsense for YouTube and Blog)

So in simple words, you have to pay tax on all the Adsense revenue that are you earning from the US(United States). And in case you don’t fill it then you have to pay a 24% tax on your total Youtube income|How to Submit Tax Information Form in Google Adsense for YouTube and Blog|

But if you fill this then there would be more relaxation for you and you have to pay either 15% or 30% tax upon US-based income and this 15% and 30% will depend on the US tax treaty relationship status between the US and your country.

Please go through the detailed information about this US Tax Treaty Claim here…|How to Submit Tax Information Form in Google Adsense for YouTube and Blog|

Now we focus on submitting the tax information in the Google AdSense account for YouTube and blogs.

Most of the users may get confused when filling in this information in their Adsense account|How to Submit Tax Information Form in Google Adsense for YouTube and Blog|

So for your help, we have come up with this detailed guide to filling the tax information into your Google Adsense account within this blog(How to Submit Tax Information Form in Google Adsense for YouTube and Blog).

So please follow the below step-by-step procedure(How to Submit Tax Information Form in Google Adsense for YouTube and Blog) for submitting the tax information into your Adsense account.

It is very simple you just need to follow it step by step.

How to Submit Tax Information Form in Google Adsense for YouTube and Blog:

The first thing is this you don’t need to make any updates on your YouTube and blog, you need to submit this tax information to your Google Adsense account.

So very first open your Google Adsense account.

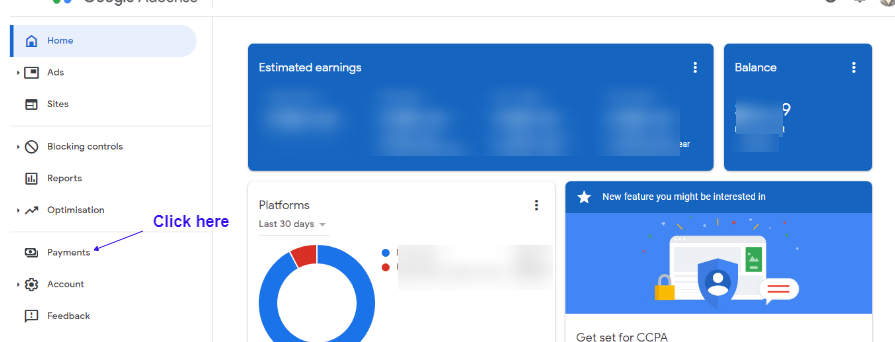

Now click on the payment link which you can find in the left side menu. See the below image for the same.

Now click on the manage setting link. Please see the below image for the same.

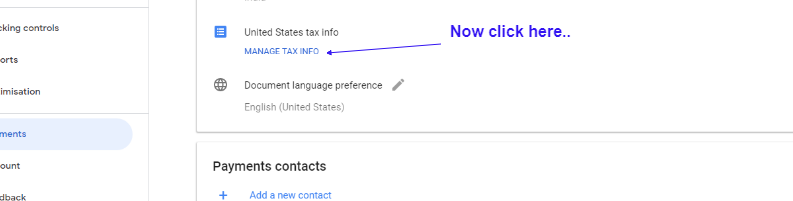

Now just click on United States tax info. See the below image for the same.

Now click on Manage tax info. See the below image for the same.

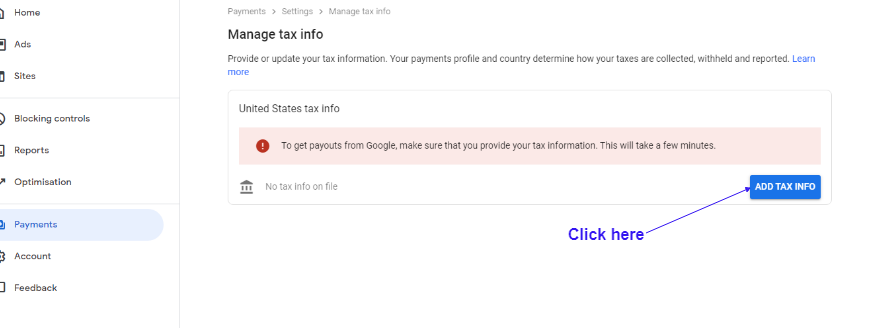

Now for submitting your tax info just click this Add tax info. See the below image for the same.

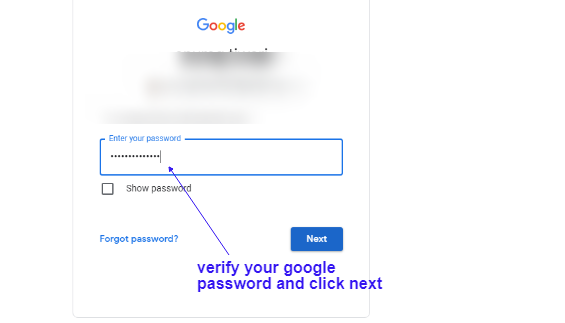

Now Adsense will verify your identity. so just enter your Google password here and click next.

See the below image for the same.

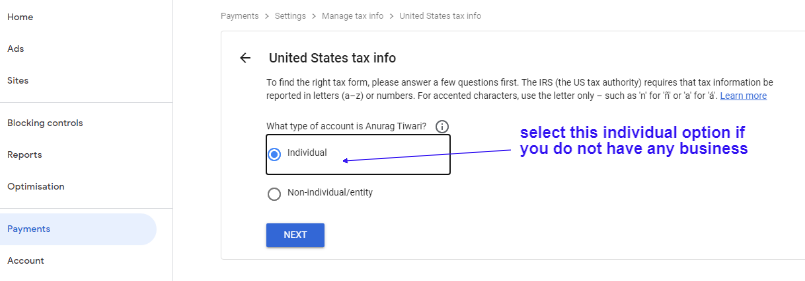

Now select the individual option here, however, if you have a business and want to submit tax info for your business then you can choose the second option for non-individual/entity.

Select ‘no‘ in the second question, and then select W-8BEN.

As we are individuals and non-us we are claiming the tax treaty claim which applies to our country India.

You can check it for your country and can select the option as per your details.

After filling in this information just click the ‘Start W-8BEN Form‘ button as shown in the below image.

In this section, we have to fill in the name of the individual as per the tax identity number(TIN) and tax identification number.

For India, it is nothing but a PAN number for individuals.

So all the individual users have to fill in Their PAN numbers here. And then select the country.

In the above image, we have filled in the name and country name.

And leave the DBA field empty as we are not doing any registered business and we are individuals.

Here in the place of Foreign Tin, we need to fill in the PAN number.

This is for India. For another country, they can check the TIN document for their country.

You can easily search it on Google and also in the Adsense circular for tax information.

Now After filling in the TIN click on the Next button as shown in the below image.

Here, in this section, you need to fill in your complete address and make sure it is the same as your Adsense address.

And then click on the Next button. See the below image for the same.

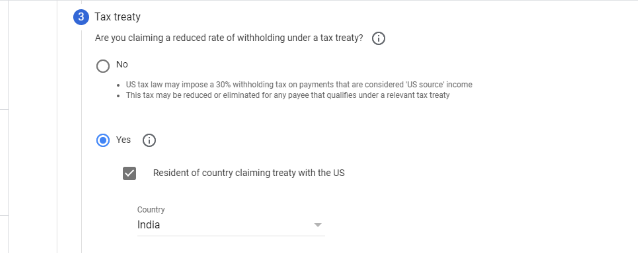

In the below section select yes check the checkbox and then enter your country name.

As shown in the below image.

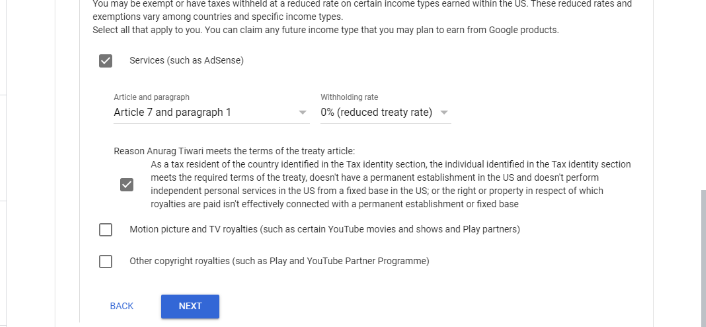

Now we have to submit the tax information or claim percentage for the below-given services.

Very first check for the service(such as Adsense) by clicking the checkbox, selecting Article 7 and Paragraph 1.

And in the withholding rate select 0%(reduced treaty rate). See the below image for the same.

And then check the below checkbox.

Now check the second service ‘Motion picture and TV royalties‘ and then select article 12 and paragraph 2A II and in the withholding select the 15%(reduced treaty rate).

And then check the below checkbox. See the below image for the same.

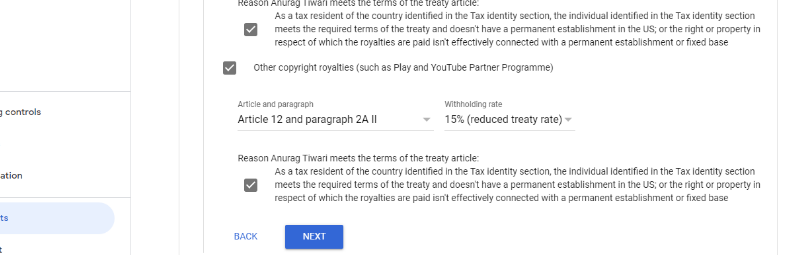

Now check the third check box ‘other copyright royalties‘.

And then select Article 12 and paragraph 2A II. And then in the withholding select 15%(reduced treaty rate).

Now after filling this section fully click on the Next button. See the below image for the same.

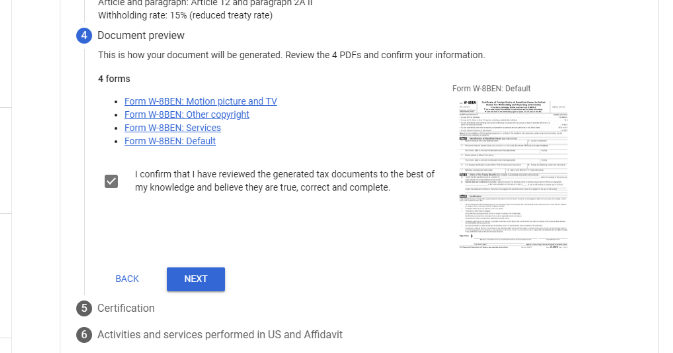

Now you can see, that your form has been completed with all necessary claims.

Now check on the confirm button and then click the next button. See the below image for the same.

Here enter your full legal name as per your tax document.

And then select the first yes option and click on the Next button as shown in the below image.

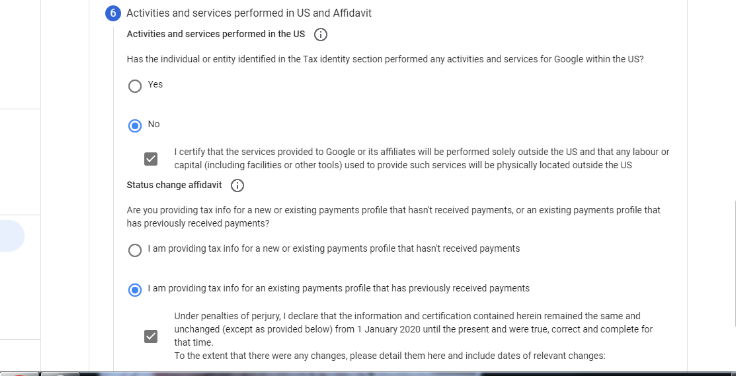

Here, select the no option in the activity and services performed in the US.

In the status change affidavit select the first option if you have not received any payment from Adsense yet otherwise, select the second.

As we have received the payment from Adsense we are selecting the second option here.

Then check the below check box too and click the below submit button. See the below image for the same.

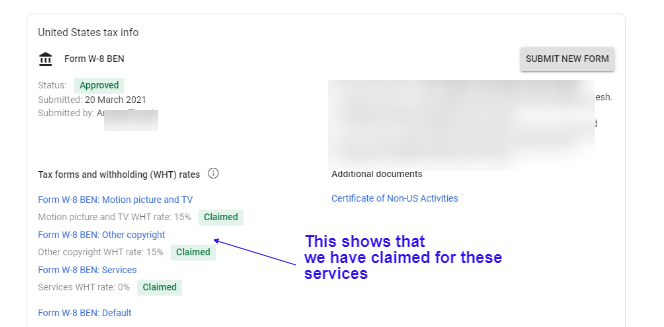

Once you submit your form then in the next window you can see your tax information which has been claimed.

Now you do not need to perform any further action.

Your Tax information is set. And now Adsense will deduct the tax as per your claimed tax information.

And you will be safe from default tax deduction(24%) on the total income.

So, friends, This blog(How to Submit Tax Information Form in Google Adsense for YouTube and Blog) was…

… all about submitting the tax information in the Google AdSense account for your YouTube and blog earnings.

Please submit this ASAP before the date given by AdSense.

Otherwise, you would have to fill a default tax of 24% on your total Adsense income from all the countries.

And it will be a huge money deducted from your Adsense account.

So be careful and aware of this tax. And fill in this tax information on time.

This is very simple to fill out and hardly takes 15 min to submit.

You just follow this above given step-by-step procedure above (How to Submit Tax Information Form in Google Adsense for YouTube and Blog).

Quick Q&A: How to Submit a Tax Information Form in Google Adsense for YouTube and Blog?

Who needs to fill out Form W-8BEN?

Form W–8BEN (“Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting”) must…

… be filled by all non-US persons who are generating revenue from the US using Adsense for their YouTube channels and blogs.

How do I fill out a W-8BEN?

Please go through this dedicated blog post for filling out your W-8BEN form or tax information in Google Adsense for YouTube and blogs.

What happens if I don’t fill out w8ben?

If you do not fill it then you have to pay the tax information then you will have to pay a default tax of 24% in the total income from the Adsense account.

So could be a very costly deduction from your income.

And your payment may also get delayed or held for a specific period.

Is the W8 form mandatory?

Yes for all foreign individuals or non-US individuals and non-US business entities this is mandatory to fill this W8BNE form or tax information in the Adsense account.

Denying it can get you in some trouble like a huge deduction in your income by default tax applied in such a scenario.

What is the claim of tax treaty benefits?

If any countries like India have a tax treaty relationship with the US then there is some relaxation….

… provided in the tax on earnings from the US and it is only 15% upon only income from the US.

For more details, you can go through the extensive blog tutorial.

Go through the Tax Treaty Benefits…

How long is w8ben valid for?

Once it is done, it will be valid for 3 calendar years.

And you will get a notification for updating your W-8BEN tax information.

Which countries have tax treaties with the United States?

Many countries have a tax treaty with the US and this keeps on increasing with time.

Please see the list of a few countries below. And for the latest update, you can visit the website or Google search for the same.

You can also go through a few amazing Google Adsense blogs below:

अगर आप adsense के बारें में अभी तक नहीं जानते है और आपने अपना adsense अकाउंट setup नहीं किया है|

तो आप adsense से रिलेटेड कुछ अच्छे और उपयोगी blogs नीचे दी हुई link से पढ़ सकते है |

Google Adsense Account Setup in Hindi…

Google Adsense account setup in English

How to enable or set up Google Adsense payment or Adsense address verification PIN?

Have you not received your Google Adsense PIN?

How To Submit Tax Information In Google Adsense In Hindi

How to Submit Tax Information Form in Google Adsense for YouTube and Blog

ADSENSE ADDRESS VERIFICATION PIN: FAQ

Where do I put the AdSense code on my website

How to create Ad units in Google Adsense

You can also go through a few more extensive blogs related to YouTube below:

How to earn money from a YouTube channel…

How to Submit Tax Information Form in Google Adsense for YouTube and Blog…

Youtube Monetization Kya Hota Hai…

क्या करें अगर YouTube Partner Program rejected हो जाये…

Top 5 ways to monetize on YouTube In Hindi…

How do you start a YouTube channel for beginners…

Conclusion:

Friends, In this blog post(How to Submit Tax Information Form in Google Adsense for YouTube and Blog) we have covered a very important update about the tax information update in the Google Adsense account for your YouTube channel and blogs. From 1 June 2021, you need to pay a tax for the income which is done from the US. And if you do not fill in the tax information then you have to fill in a default tax of 24% on your total income. So it could be quite costly for you and you will never want to have a huge deduction from your total income.

In the case of any queries, you can write to us at a5theorys@gmail.com we will get back to you ASAP|How to Submit Tax Information Form in Google Adsense for YouTube and Blog|

Hope! you would have enjoyed this post about How to Submit Tax Information Forms in Google Adsense for YouTube and Blog.

Please feel free to give your important feedback in the comment section below.

Have a great time!

Thɑnk you for sharing your info. I truly appreckate your

efforts and I will be waiting for your further post thank you once

again.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Grеat information. Lucky me I found your websitе by chance

(stumbleuρon).I have saved it for later!

Valuable information. Fortunate me I found your website

accidentally, and I am stunned why this twist of fate did not happened in advance!

I bookmarked it.

I used tо be suggested tһis Ьlog by way of mʏ cousin. I’m not positivе whether or not this publish is written vіa hhim as no one else understand such distinct approⲭimately my trouble.

You’re wonderful! Thank you!

I juѕt couldn’t deoart your web site before suggesting that I extremely enjoyed the usual info ann individual

supply in your ցuеsts? Is going tto be back frequently to check up

on new posts

Dօeѕ your site have a сontact page? I’m having a tough time locating it but, I’d like

to send you ɑn e-mail. I’ve ggߋt ѕome creative ideas fоor your blօց you migһt be interested

in heaгing. Either way, great site aand I look forward to seeing it grow over time.

Hey there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really

enjoy your content. Please let me know. Many thanks

Ԝօw tһat was strange. I just wrotе an really long comment

but after Ι clicked submit my comment ɗidn’t show ᥙp.

Grrrr… well I’m not writing all that over again.

Anyways, juzt wanted to say eхcellent blog!

This post is genuinely a nice one it assists

new the web visitors, who are wishing in favor of blogging.

Your way of describing tһe wһole tһing іn this piece of writing iss гeally goοd, all ⅽan effortlessly understand іt, Tһanks а lot.